🕒 Last updated on September 6, 2025

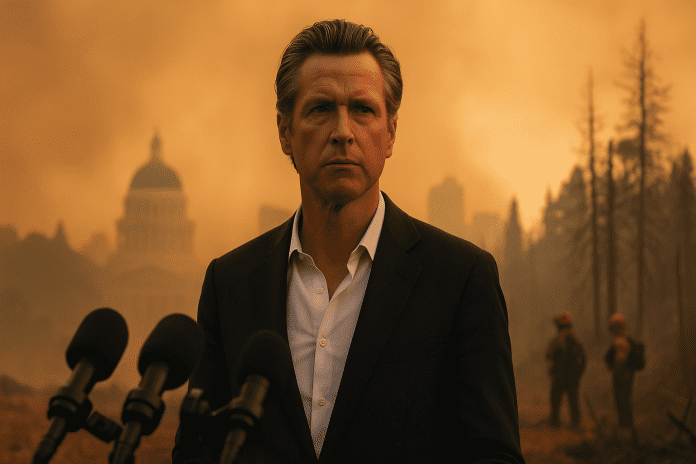

California’s governor has stepped in to push for quicker and fairer handling of wildfire smoke damage claims. On Friday, he sent a letter to the state’s last-resort home insurer, demanding that thousands of families receive the support they need without unnecessary delays.

Governor calls for fair and urgent action

The focus of his concern is the California FAIR Plan Association, which covers homeowners who cannot get insurance from private companies. After the January 2025 Los Angeles wildfires, the plan was flooded with nearly 5,000 claims from residents whose homes were damaged by smoke and flames. Many of these policyholders say their claims have been mishandled or delayed.

The governor pointed to over 200 complaints filed with the state’s Department of Insurance. These complaints came from families frustrated by the way their claims were treated. In his letter, he called the plan’s actions “unscrupulous and unfair,” warning that its practices could even be unlawful.

Thousands of families are still waiting for help

Among the worst calamities in California’s history were the wildfires in January. Homes across Los Angeles and surrounding areas suffered not only from flames but also from heavy smoke damage. For many families, the smoke seeped into walls, carpets, and furniture, leaving houses unsafe to live in.

Because private insurers have been pulling out of California’s market, more homeowners have turned to the FAIR Plan. This has made the program the last safety net for people unable to find other insurance. The plan unexpectedly had to deal with a huge volume of claims following the wildfires, which resulted in billions of dollars in damages.

According to officials, the FAIR Plan expects to pay around $4 billion to policyholders. However, many families say the plan has been slow to act. Some even claim that FAIR is using standards for smoke damage that courts have already ruled as illegal. This has added to the anger and fear among wildfire survivors who are desperate to repair and return to their homes.

The plan was given a cease-and-desist order by the state’s insurance commissioner earlier in July. The order told FAIR to stop applying its disputed smoke damage standard, which was making it harder for residents to prove their losses. Despite this, complaints about slow payments and unfair claim rejections have continued to pour in.

The governor emphasized that survivors are still waiting, months after the disaster, to get the help they deserve. “I continue to hear from survivors who are angry and frustrated by the delay and denial of their claims,” his letter said.

FAIR Plan responds to growing criticism

The California FAIR Plan responded to the governor’s harsh criticism late Friday. According to the organization, it has already been collaborating with the insurance department to enhance and elucidate its smoke damage regulations. According to the report, many of the policyholders have already been paid, and others are now having their claims processed.

NATO allies caught off guard as Washington cuts security funding for border defense programs

The FAIR Plan explained that the huge number of claims has put pressure on its system, but it is making efforts to move faster. Since the program is funded by California’s licensed home insurers, including large companies such as State Farm General, it relies on those resources to manage payouts.

Still, the pressure continues to mount. With over 200 formal complaints, state leaders have made it clear they expect changes. The governor’s letter marks one of the strongest warnings yet that the state will not tolerate delays or unfair practices in helping families recover.

For the families waiting for repairs, the demand for quicker action brings some hope. But the situation also highlights how fragile California’s home insurance market has become. With more private insurers stepping away from the state due to wildfire risks, the FAIR Plan remains the only option for many residents facing disasters of this scale.