🕒 Last updated on September 11, 2025

Asia is one of the fastest-growing regions in the world when it comes to energy use. Rapid industrial development, the rise of huge data centers, and the growing demand for electricity in cities are driving massive growth.

Fossil fuel support slows renewable growth

But even as renewable energy technology becomes more available, coal continues to receive heavy subsidies from governments.

These subsidies make coal cheaper for power producers, which in turn keeps retail electricity prices low. Many governments argue that this is necessary to keep electricity affordable for ordinary households and businesses. However, this financial support for coal is making it difficult for renewable energy to compete on equal terms.

Industry experts have warned that as long as coal is subsidized, investments in solar, wind, and other clean energy projects will face challenges. They believe coal subsidies distort the market, pushing investors away from clean power. The reliance on coal is not just an energy issue but also a political one. In many countries, energy pricing is used to win votes, making it even harder to shift away from fossil fuels.

🧱 Finland builds world’s largest sand battery — and it’s heating homes without oil or pollution

Cancelled projects and rising uncertainty

A major concern for companies looking to build renewable projects in Asia is policy instability. Investors can handle risks if they are clearly laid out in advance. But in many Asian countries, rules around renewable energy projects change suddenly, or approvals are delayed for years.

One of the biggest problems is the cancellation of renewable energy auctions and tenders. These auctions are meant to bring in private companies to build wind farms, solar parks, or other projects. But when governments cancel them, companies lose confidence. In some countries, billions of dollars’ worth of renewable projects have been cancelled or delayed because governments felt the price bids were too high.

Uncertainty also affects long-term agreements between power producers and governments. In several cases, power purchase agreements signed for renewable projects have been called into question, making them less attractive to banks and investors. Without financial backing, projects cannot move forward.

Experts say that it is not technology holding back the growth of renewable energy. Instead, it is unpredictable policies and unclear rules. For example, if it takes four years to get a permit, developers can plan for that delay. But if rules are changed halfway or permits are revoked, companies face losses they cannot control. This makes financing renewable energy much more expensive.

These challenges are not limited to one country. Across Asia, examples have emerged of governments cancelling projects or changing rules suddenly. In one case, offshore wind licenses were revoked after review. In another, more than 11 gigawatts of renewable projects were cancelled over just two years. Such actions discourage companies from committing their money and expertise to new projects.

Data centers and coal dependence

Another factor shaping Asia’s energy demand is the rise of data centers. These facilities store and process massive amounts of information, powering everything from cloud storage to streaming services. Data centers require enormous amounts of electricity, and their growth is pushing demand to record levels.

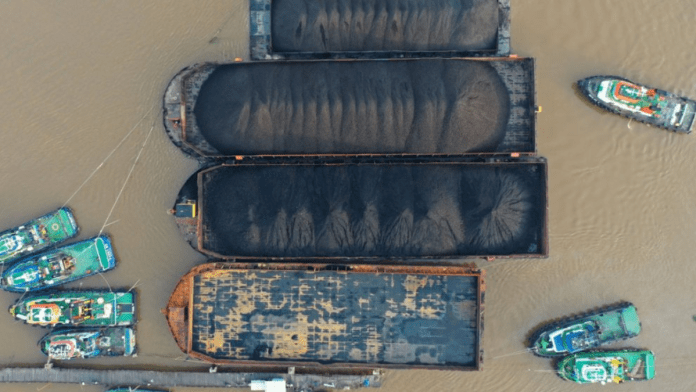

But experts say that data centers are not yet pushing for clean power. Their main priority is a reliable energy supply, not the carbon footprint of the electricity they consume. This has resulted in increased demand for coal-fired power, especially in countries where coal is readily available or cheap to import.

For example, some countries in Southeast Asia are ramping up coal power to feed new data centers. Imports of coal are rising, and governments are boosting coal-fired generation to ensure a stable supply. This trend is in direct contrast to the global push for clean energy and lower emissions.

Delays in renewable projects also mean that demand created by data centers is being met by fossil fuels. This raises costs in the long run, as financing for renewable energy becomes more expensive due to policy instability. Meanwhile, coal remains attractive because of government support and lower short-term prices.

$10B Qatari investment pledge drives momentum for new India–Qatar trade pact

Still, some companies remain committed to clean energy development in Asia. They are focusing on countries where policies are more predictable, such as Japan and Australia. In these places, while risks remain, the overall rules are clearer. This allows developers to reduce costs and plan projects with more certainty. Predictable timelines and stable policies are key factors that attract investment in these regions.

Across Asia, however, the larger picture remains the same: coal subsidies, cancelled auctions, and unstable rules are slowing down the energy transition. As electricity demand soars, especially from energy-hungry industries like data centers, fossil fuels continue to dominate. Without stable and clear policies, renewable energy developers face growing challenges, and Asia’s path to a cleaner future remains uncertain.